Employment Miscellaneous Provisions Act 2018

How does the Employment Miscellaneous Provisions Act 2018 affect me?

The Employment Miscellaneous Provisions Act 2018 came into effect on the 4th of March 2019 outlining several changes being made to already existing legislation. There are five key changes being made to existing Acts which are:

1. The “Day 5” Statement

Changing the Terms of Employment ( information) Act 1994, the Day 5 Statement states that employers must notify all new employees of the following core terms of employment:

- The full names of the employer and employee

- The address of the employer

- The expected duration of the contract if it is a temporary contract or fixed term

- The rate of the employee’s pay

- The working hours the employer reasonably expects the employee to work per day or per week.

These have to be presented, in writing, to the new employee within five days of commencement of employment. Following this, full written terms of the employment contract must be issued within two months of commencement of employment. Failure to meet these requirements may result in a fine of €5000, a 12-month prison term or both.

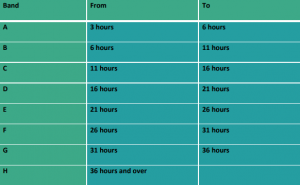

2. Banded Hours

Having worked over a 12-month reference period, employees are now entitled to request a band of hours that better reflects the hours they work to be put in place if their contract of employment, or statement of terms does not reflect the reality of the hours they habitually work. Once a request had been made in writing the employer has four weeks to consider the request and provide reasonable defences if they chose to refuse. If banded hours have already been agreed with the employee and employer, for example in the retail sector, these new provisions will not interfere.

3. Zero Hour Contracts Prohibited

Employers are no longer allowed to issue zero hour contracts unless one of the following applies:

- Where work is of a casual nature

- Where the work is done in emergency circumstances

- Short-term relief work to cover routine absences for the employer

4. Minimum Payment Entitlement

Section 18 of the Organisation of Working Time Act 1997 has been amended to introduce minimum payment entitlement in certain circumstances. This will only apply to an employee who is called into work and does not receive the expected hours of work. On each occasion, the minimum payment is three times the national minimum hourly rate of pay, at least 25% of the contract hours or 15 hours pay.

5. Changes to the National Minimum Wage Act 2000

Minimum wage rates for employees under 18 and over 18 have been changed so that they are solely based on age rather than age and experience. These rates are shown in the table on the right.

For More on the Employment Miscellaneous Provisions Act 2018 and related topics read:

Paycheck Plus, Your Payroll Outsourcing Partner

Managing payroll can be a complex and time-consuming operation for businesses. Employee queries, employment updates, staff changes in status, keeping up to date with legislation, ensuring payroll compliance etc. can all take its toll on a business’ internal payroll resources. Here at Paycheck Plus, we’ve been providing comprehensive payroll services tailored specifically to each of our client’s needs for over a decade. Our payroll specialists handle all aspects of payroll management for our clients including answering our client’s employee queries through our Employee Assist Helpline.

To ensure payroll accuracy or for more information on our payroll services simply request a callback now or call our office on 041-9892100. Alternatively, request a quote here.